crypto tax calculator canada

The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the. We unify your transaction history across every crypto service and make it searchable and filterable.

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Canada has a few tax breaks that crypto investors will be interested in.

. Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you can print tax reports including an income report capital gains report and a buysell report. Only half your crypto gains are taxed. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations.

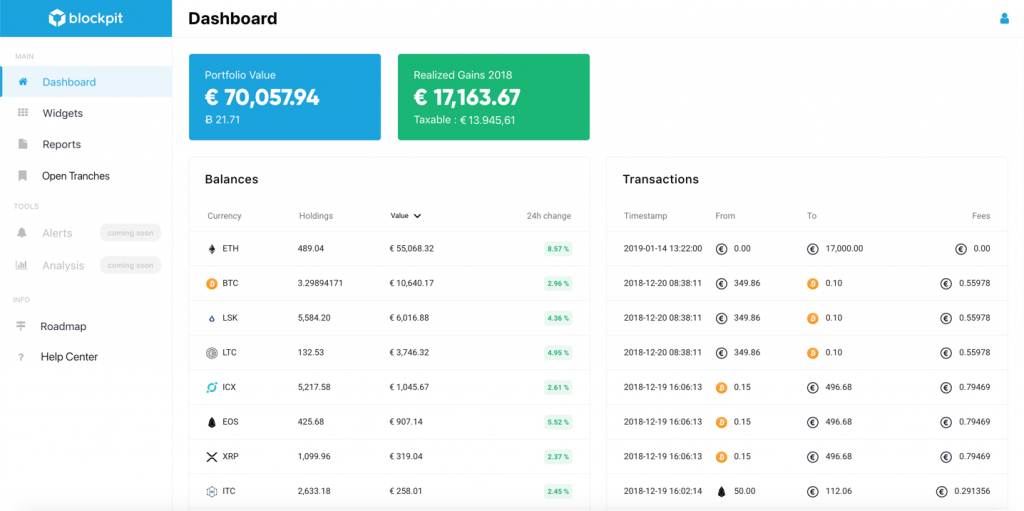

So crypto tax calculator software like Koinly makes it more accessible. You can use crypto as an investment as a currency for spending or as a source of passive income. View your market value investment performance and portfolio allocation in real time and for tax purposes.

Capital gains tax report. Can you avoid crypto taxes in Canada. You can calculate this in a couple of different ways but the easiest way is to add up all your capital gains and then halve the amount.

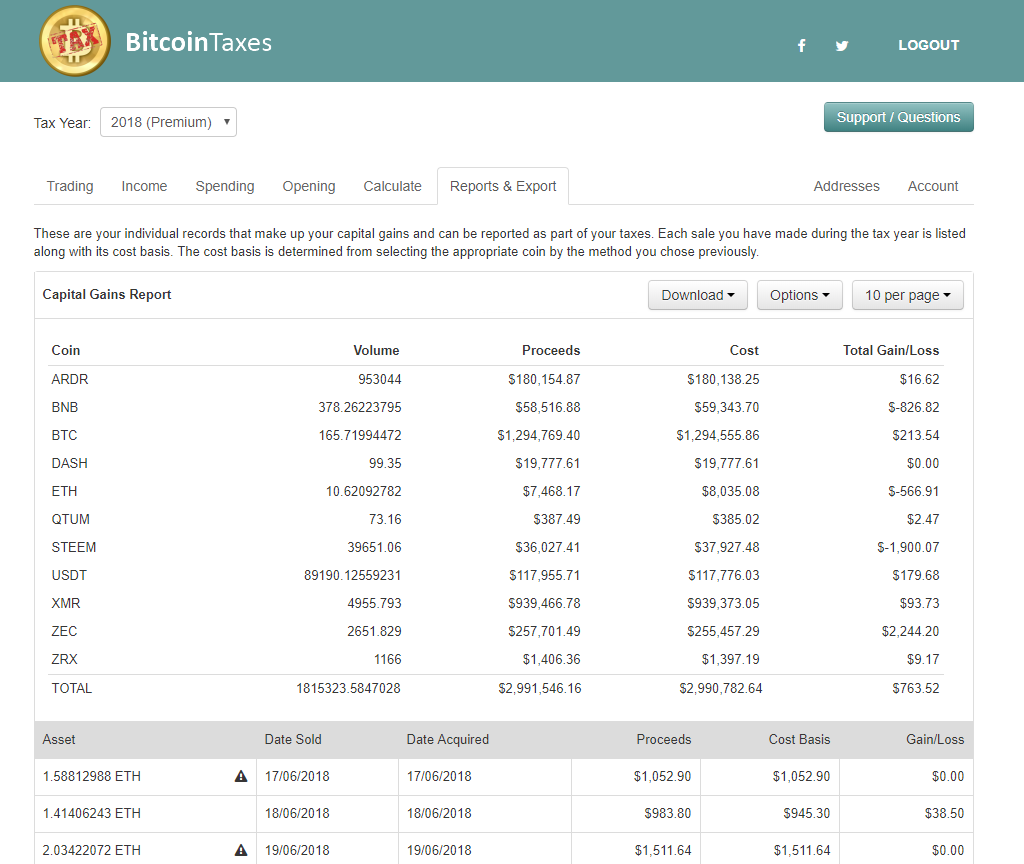

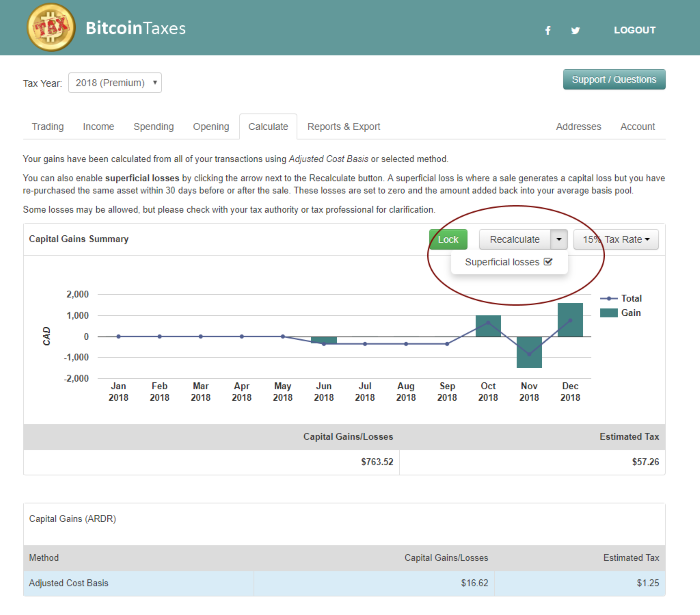

Calculate and report your crypto tax for free now. Adjusted cost basis and superficial losses Canada Pooling with same-day and 30-day rules United Kingdom Spot pricing for more than 20000 trading pairs. Canadian citizens have to report their capital gains from cryptocurrencies.

TurboTax TaxACT and HR Block desktop 9999999e06. CryptoTraderTax is the fastest and easiest crypto tax calculator. Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada.

Crypto Tax Calculator Highlights Supports Canada Revenue Service tax guidelines including Canada-specific rules around personal use mining staking and airdrops. Picks up all transactions across main exchanges metamask even OpenSea. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains.

Australia Canada New Zealand Singapore United Kingdom. Crypto Tax Calculator is a crypto tax software platform that supports over 400 exchanges and 100000 transactions. There is no legal way to avoid paying taxes on cryptocurrency in Canada.

Straightforward UI which you get your crypto taxes done in seconds at no cost. Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains.

Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. Thankfully the numbers seemed to align with my calculations on simpler CGT disposals. Paying taxes on cryptocurrency in Canada doesnt have to be a headache.

Report crypto on your taxes easily using Koinly a crypto tax calculator and software. While crypto transactions are conducted anonymously the CRA does have the right to demand customer data from crypto exchanges. File your crypto taxes in Canada Learn how to calculate and file your taxes if you live in Canada.

Crypto taxes in Canada are confusing because there are so many use cases for crypto. Cryptocurrency Tax Calculator. Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how.

Koinly is also compatible with many other countries including the UK and USA. Bitcoin Tax Calculator for Canada. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

The calculator also has international support for people living in Canada the UK Germany and several other countries. Download Schedule D Form 8949 US only Reports and software imports eg. Guide for cryptocurrency users and tax professionals.

Crypto tax breaks. Crypto tax calculator seems like a really robust bit of software. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes.

Join over 100000 crypto investors calculating their profits losses and tax liabilities today. And when it came to my 200 Eth transactions it looks like it has reconciled them all. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD.

7 best crypto tax software. Automated Crypto Trading With Haru. Youll only pay Capital Gains Tax on half your capital gains.

It uses this data to figure out who has crypto-related income that should be reported on taxes. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat. We support for 300 exchanges 10000 cryptocurrencies.

Coinpanda generates ready-to-file forms based on your trading activity in less than 5 minutes.

The Ultimate Canada Crypto Tax Guide 2022 Koinly

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Crypto Tax Calculator 2022 Online Tool Haru

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Cryptocurrency Taxes Canada 2022 Guide Finder Canada

Koinly Review Is It Good For Canadians March 2022 Updated

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Taxes In Canada Adjusted Cost Base Explained

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Koinly Review Apr 2022 Cryptocurrency Tax Made Easy Yore Oyster